Saving hacks for university student

- X-Press Journalist

- Feb 14, 2019

- 3 min read

Updated: Mar 5, 2019

By Chen Sune Yee, Ng Jia Yin

The daily expenses in university is expensive and it is inevitable for you to not use up your monthly allowance in the beginning of the month. However, with a few changes, you can save a lot of money over time so that it can help you achieve your goals in the future.

According to Iris Chee, a student from Xiamen University Malaysia, her allowance is enough for her to spent over the month. However, she will be facing insufficient money to spend at the end of the month because she spent them mostly on transportation and food.

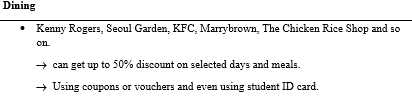

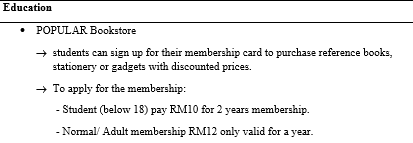

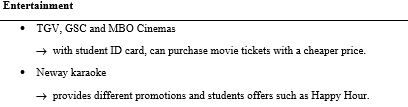

First, you should take advantage of student discounts. As a student, you should make full use of your student card to get a discount for education, entertainment, transportation or dining if they offer promotions and discounts for students.

“I saved a lot when I applied for a student KTM card when my friends told me that it was the half price of the actual fee, I do not need to worry about the transportation fees will exceed my budget as I go home every week,” said Rachel Chen, a university student from Xiamen University Malaysia. Therefore, take advantages of the student discount by just flashing your student ID card or apply for the membership cards this will help you save and avoid spending unnecessary expenses.

Next, you should always be clear of what you need and what you want to buy so that you can always set a budget for it. Necessities is always prioritized as they much more important than items that you want. Being able to differentiate both of them clearly, you can list out what you are going to purchase. In this way, well-planned purchases can change your habit to be more self-controlled and avoid spending on things that are not necessary and waste your money as you will think before you purchase anything. You should set a budget that do not exceed your monthly allowance and stick to it so that you can control your spending. So, you should not let your desire and emotions to control your spending habits. “I will always list out the groceries I need to buy when I go for my grocery shopping, I feel satisfied cancelling the items that I have put in my shopping cart” said Weiyee who does her grocery shopping every weekend.

Moreover, you can save your money by creating a bank account. This method is better than keeping your money at home because you tend to spent more when you can get money by just stretching your hand. When you need money to buy something you can just get them at the place where you keep our money at home whereas if you keep our money in the bank account you have to go all the way to the nearest ATM just to withdraw money. There are times where you are lazy to walk a few meters to withdraw money and this is the times where you get to save your money because your laziness surpasses your temptation to buy something. This is also a time where laziness actually provides you benefit.

Last but not least, keeping track of your expenses is also a way for you to manage your finance. There are many ways you can keep track on what you spent. The first way is the traditional way where you can jot down how much you spent in a notebook and at the end of the month you can calculate everything and get the total amount you spent in a month. Another way is you can make good use of the technology which is installing an app in your smartphone. you can key in every expenses you make in that app. This way is easier and faster compare to the traditional way because you do not have to calculate the total amount physically at the end of the month because the app will calculate them automatically and inform you through notification.

In a nutshell, university life is not always about burying your nose in the textbook but it is also the best time for you to learn about financial management so that you are more conscious about your daily spending. When you are not conscious enough about your spending, you will easily get into troubles which you might be tricked by your friends, have a higher probability to face the problem of bankruptcy in the future and even be labelled as a spendthrift. Therefore, having the knowledge about financial management is extremely important because it helps us to manage our finance and prevent overspending in the future.

Comments